India Ratings and Research (Ind-Ra) has assigned GAIL Gas' (GGL) Rs 1,773.5 million bank facilities (including long-term loans, short-term loans and cash credit) final 'IND AA'/Stable and 'IND A1+' ratings. The agency has also assigned the company's Rs 52.4 billion non-fund-based limits final 'IND AAA(SO)'/Stable and 'IND A1+(SO)' ratings.

India Ratings and Research (Ind-Ra) has assigned GAIL Gas' (GGL) Rs 1,773.5 million bank facilities (including long-term loans, short-term loans and cash credit) final 'IND AA'/Stable and 'IND A1+' ratings. The agency has also assigned the company's Rs 52.4 billion non-fund-based limits final 'IND AAA(SO)'/Stable and 'IND A1+(SO)' ratings.

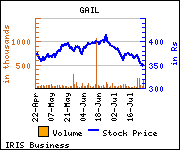

The ratings are driven by GGL's strong legal, operational and strategic ties with its 100% owner, GAIL (India) (GAIL, 'IND AAA '/Stable). GAIL has been supporting GGL through regular equity infusions and corporate guarantees for part of its debt where required. GGL sources its entire gas for operations from GAIL. GGL's business is a natural extension of GAIL's core business. GGL is strategically important entity for GAIL for diversification and expansion of its businesses. GGL's business in Taj Trapezium Zone (TTZ) was transferred from GAIL. The ratings build in GAIL's explicit and implicit support to GGL's debt in future.

The government of India has mandated the allocation of 1.1mmscmd of administered price mechanism (APM) gas to GGL for supply to industries located in TTZ. Demand for the gas is high as it is cheaper (around Rs 18/SCM) than alternative non-polluting fuels. Ind-Ra believes that the demand will remain unaffected as long as the availability of APM is ensured to TTZ, thereby insulating the cash flow to GGL from price competitiveness of alternate fuels.

The government of India has mandated the allocation of 1.1mmscmd of administered price mechanism (APM) gas to GGL for supply to industries located in TTZ. Demand for the gas is high as it is cheaper (around Rs 18/SCM) than alternative non-polluting fuels. Ind-Ra believes that the demand will remain unaffected as long as the availability of APM is ensured to TTZ, thereby insulating the cash flow to GGL from price competitiveness of alternate fuels.

Presently, the prices of gas supplied to the domestic and commercial segment of PNG are structured on a cost-plus basis and benchmarked to LPG prices. This is because the prices of crude and alternative fuels are low. The CNG and industrial PNG prices are also determined similarly but benchmarked to price/diesel and furnace oil/LSHS, respectively. The cost-plus pricing structure limits the gross margin GGL can earn, as higher margin may erode the price competitiveness of natural gas over other alternate fuels.

GGL's revenue grew at a CAGR of 85% to Rs 9.88 billion in FY14 from Rs 2.87 billion in FY12 due to the increased demand from piped natural gas (PNG) customers, particularly TTZ. During FY14, GGL sold total of 530.9mmscm (1.45mmscmd) of natural gas, of which around 97% was sold to TTZ. TTZ’s industrial customers accounted for 92% of the total sale of GGL's entire industrial segment or 89% of total sale of GGL to all customers.

The four cities - Dewas, Sonepat, Meerut and Kota - put together contributed only 11% to GGL's total volume of gas sold in FY14 and scenario is not likely to change materially in near future. The lower density of population and lesser number of multi-floor buildings in these cities result in a higher per unit cost of laying pipelines, requiring higher capex on network expansion for domestic PNG. In the CNG segment, as these cities have a smaller periphery, daily average distance commuted per vehicle is low. Hence, the incentive for switching to CNG is less compelling. GGL has thus seen slow growth in network expansion.

GGL was in February 2015 granted the authorisation to lay, build, operate or expand the CGD network in Bengaluru's urban and rural districts It is projecting a capital outlay of Rs 13 billion in the next five years, which will be funded in a debt:equity of 70:30. GAIL will infuse Rs 4 billion of the equity required. GGL has also participated in six other CGD bidding processes, results of which are awaited. In the likely scenario of award of any of these bids, GGL will have to depend entirely on GAIL for equity commitments as its internal accruals would be insufficient.

Bengaluru is comparable to cities like Delhi or Mumbai both demographically and infrastructure wise. So, the two factors - average daily commuting distance and number of households served through per inch-km of network - work out favourably for CGD business. Additionally, the pricing structure is better as margins will include both network/compression tariff and marketing margin. Ind-Ra believes Bengaluru will be driving GGL's volumes, revenue and margins two-three years down the line.